Мэдээлэл шинэчилсэн огноо: 2024.03.15

Money Laundering

Money laundering is the process of illegally concealing the origin of money obtained from illicit activities, making them appear to have originated from legitimate sources.

An act of laundering money (money laundering) is determined in the international convention (United Nations Convention against Transnational Organized Crime, Palermo, 2000) as below:

- The conversion or transfer of property, knowing that such property is the proceeds of crime, to conceal or disguise the illicit origin of the property or of helping any person who is involved in the commission of the predicate offense to evade the legal consequences of his or her action;

- The concealment or disguise of the true nature, source, location, disposition, movement, or ownership of or rights concerning property, knowing that such property is the proceeds of crime;

- The acquisition, possession, or use of property, knowing, at the time of receipt, that such property is the proceeds of crime;

- Participation in, association with, or conspiracy to commit, attempts to commit, and aiding, abetting, facilitating, and counseling the commission of any of the offenses established by this article.

According to the Financial Action Task Force (FATF) Recommendations, countries should apply the crime of money laundering to all serious offenses, with a view to including the widest range of predicate offenses. Predicate offenses include but are not limited: to participation in organized crime, fraud, drug trafficking, corruption, bribery, and tax crimes.

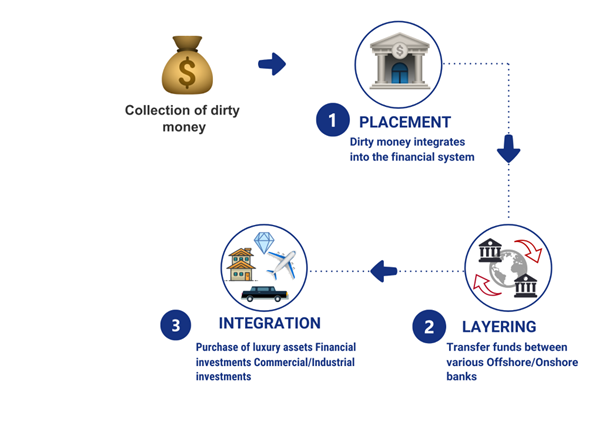

The following figure shows the three steps of money laundering:

- Placement. The placement is the initial step in which illicit funds are introduced into the legitimate financial system. Illegal funds are transferred or collected. The proceeds of crime can be deposited into the financial system in the form of cash, bank accounts, virtual assets, etc.

- Layering. After placing illegal funds in the financial system, the layering stage is the origin of the funds is concealed by transferring and converting them using various techniques. Techniques used in the layering stage include making non-cash transfers, depositing in bank accounts, converting into a loan or payment for goods, dividing, combining, transferring between banks, transferring between countries, converting cryptocurrency to another, transferring from one blockchain to another, etc.

- Integration: In the final stage, criminals return illicit money to themselves. The laundered funds integrated into the financial system, criminals are received in the accounts of shell companies or relatives which can be used for any purpose. Common methods include purchasing high-value items such as real estate, art, or investing in businesses, dividends, and payment of non-existent employees.

The following figure shows the stages of money laundering:

Financing of Terrorism

As stated in Article 3.1.2 of the Law on AML/CFT, “financing of terrorism” is defined as the direct or indirect accumulation, alteration, transfer, and expenditure of assets by terrorist entities knowing that they will be used to carry out terrorist acts and activities. In other words, terrorist financing is the act of accumulating, transferring, or spending legal or illegal funds and income for individuals, organizations, and other persons who intend, plan, or participate in terrorism.

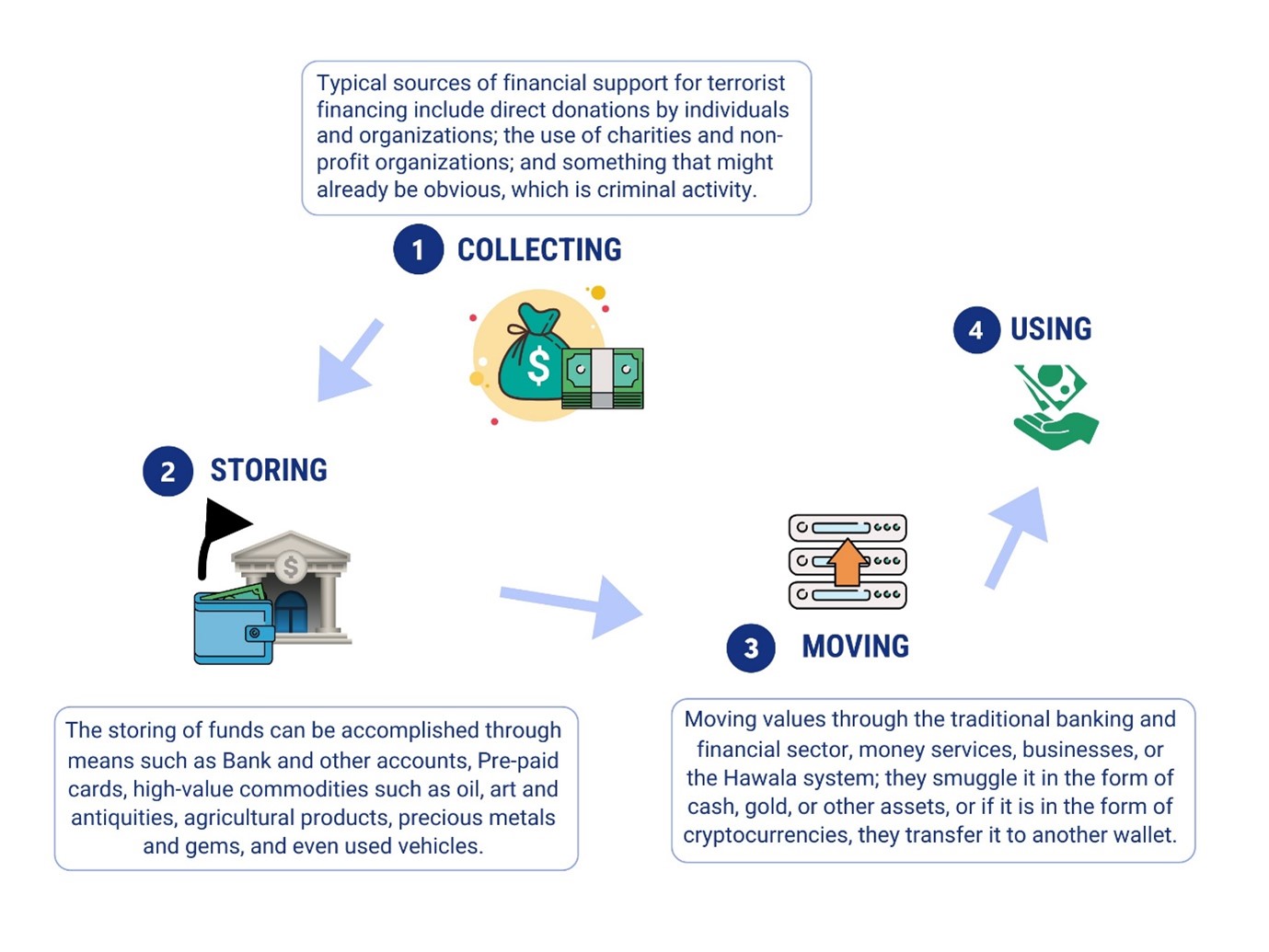

The stages of terrorist financing:

- Collecting: In the first stage, the collection stage, funds are raised for terrorist activities. This fund can be financed from a variety of sources as listed below.

- Storing: The second stage involves depositing the collected funds into a bank account, buying cryptocurrencies, paying credit card bills, and purchasing oil, paintings, antiques, agricultural products, precious metals, vehicles, etc.

- Moving: Terrorist groups and individuals transfer the funds they have accumulated while carrying out their terrorist activities.

- Using: The funds are used to pay for weapons, materials, equipment, media and training, salaries, documents, visa costs, and plane tickets to be used in terrorist activities. Some of the forms of usage are also day-to-day expenses which are difficult to identify as terrorism-related.

Terrorism is usually funded by income from the following sources, including:

Proliferation Financing

In accordance with the UN Security Council Resolution 1540, the Financial Action Task Force (FATF) defines financing the proliferation of weapons of mass destruction (proliferation financing) as the act of providing funds or financial services that are used, in whole or in part, for the manufacture, acquisition, possession, development, export, trans-shipment, brokering, transport, transfer, stockpiling, or use of nuclear, chemical, or biological weapons and their means of delivery and related materials (including both technologies and dual-use goods used for non-legitimate purposes), in contravention of national laws or, where applicable, international obligations.

UN Security Council Resolution 1540 and other relevant resolutions, as well as FATF Recommendation 7 and Immediate Outcome 11, establish key standards and requirements for countries to address proliferation financing. These standards delineate the roles and responsibilities of jurisdictions in combating proliferation financing, as well as the criminal, civil, administrative, and financial measures that should be taken for effective enforcement. If a jurisdiction fails to comply with the necessary requirements to combat proliferation financing, the Sanctions Committee of the UN Security Council may issue a resolution and impose targeted financial sanctions against that jurisdiction.

The stages of the proliferation financing:

1. Program Fundraising

In cases where a government finances the proliferation of weapons of mass destruction, funds are raised through the state budget, or profits from an overseas commercial enterprise network, and/or proceeds from an overseas criminal activity network. Proliferation actors and networks use businesses that generate money and income from different sources to purchase conventional goods and dual-use goods and then sell them directly or through related parties to final recipients.

2. Disguising the Funds

To hide their finances, criminals use shell companies to transfer illegal funds through the international financial system. Covering the proliferation financing often involves legal entities from jurisdictions subject to economic sanctions or from neighboring jurisdictions.

3. Materials and Technology Procurement & Delivery

The criminals use the funds raised to purchase materials, dual-purpose goods, and technology that can be used for the proliferation of weapons of mass destruction, and transport them to the destination in a hidden manner.

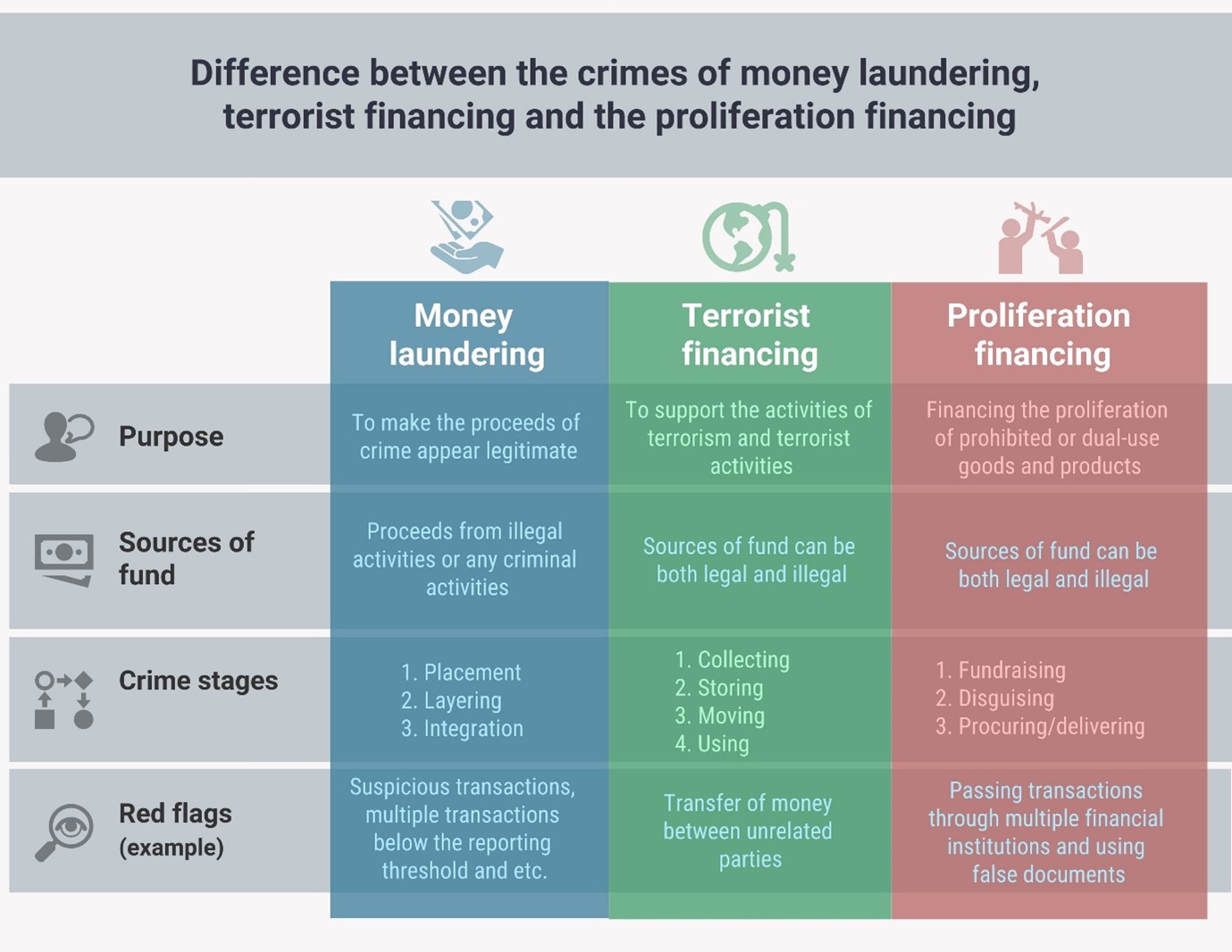

Difference between the crimes of ML/TF/PF